How can I reduce my tax owed?

Contribute to a Retirement Account

You can deduct contributions to traditional 401(k)s and IRAs from your taxable income and reduce the amount of federal tax you owe. These funds also grow tax-free until retirement. There are also Roth IRA accounts, which are funded with after-tax dollars.

Contribute to a Retirement Account

You can deduct contributions to traditional 401(k)s and IRAs from your taxable income and reduce the amount of federal tax you owe. These funds also grow tax-free until retirement. There are also Roth IRA accounts, which are funded with after-tax dollars.

An offer in compromise lets taxpayers settle their tax debt for less than the full amount they owe. It may be an option if they can't pay their full tax liability or doing so creates a financial hardship. The IRS considers a taxpayer's unique set of facts and circ*mstances when deciding whether to accept an offer.

Tax credits like the Earned Income Tax Credit, Child Tax Credit, Child and Dependent Care Credit, and American Opportunity Tax Credit reduce the taxes you owe, not just your taxable income.

Having enough tax withheld or making quarterly estimated tax payments during the year can help you avoid problems at tax time. Taxes are pay-as-you-go. This means that you need to pay most of your tax during the year, as you receive income, rather than paying at the end of the year.

General Initiative Eligibility

You should be current on all federal tax filings and owe no more than $50,000 in back taxes, interest and penalties combined. If you're a small business owner, you could be eligible for relief under the Fresh Start Initiative if you owe no more than $25,000 in payroll taxes.

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

6 years - If you don't report income that you should have reported, and it's more than 25% of the gross income shown on the return, or it's attributable to foreign financial assets and is more than $5,000, the time to assess tax is 6 years from the date you filed the return.

How much will the IRS settle for? The IRS will often settle for what it deems you can feasibly pay. To determine this, the agency will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

You can talk directly to negotiate a deal with the IRS.

There are people who manage to negotiate “the deal of a lifetime” with the IRS. They get the IRS to drop all the penalties and some or all of the interest, and they can also name their price on an installment agreement.

Why do I owe taxes if I claim 0?

If you claimed 0 and still owe taxes, chances are you added “married” to your W4 form. When you claim 0 in allowances, it seems as if you are the only one who earns and that your spouse does not. Then, when both of you earn, and the amount reaches the 25% tax bracket, the amount of tax sent is not enough.

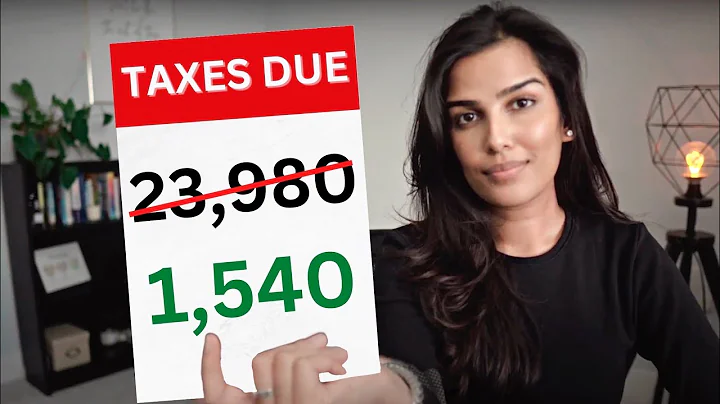

You may owe taxes to the IRS if you earn income but there are certain steps you can take to minimize the amount of tax you owe on your earnings at the end of the year. This includes saving money for retirement, taking part in employer-sponsored retirement plans, and using tax-loss harvesting as a strategy.

Different income tax brackets apply depending on how much money you make. Generally speaking, a higher percentage is typically taken out of your paycheck if you earn a higher level of income.

The most common reason why taxpayers end up owing money to the IRS is because they did not have enough money taken out of their paychecks throughout the year, according to tax experts. When employees first start a job, they fill out a W-4 form, which determines how much money is withheld from their paychecks for taxes.

“The best strategy is breaking even, owing the IRS an amount you can easily pay, or getting a small refund,” Clare J. Fazackerley, CPA, CFP, told Finance Buzz. “You don't want to owe more than $1,000 because you'll have an underpayment penalty of 5% interest, which is more than you can make investing the money.

Answer: The IRS Hardship Program, also known as the Currently Not Collectible (CNC) status, is a program that provides temporary relief to taxpayers who are experiencing financial hardship and cannot afford to pay their tax debt.

Tax relief companies are sometimes thought to be disreputable due to customer complaints about false promises, high fees, and even scams. While it's true that the tax relief industry has some bad players, there are also plenty of reputable tax relief companies with proven records of success.

If you filed on time but didn't pay all or some of the taxes you owe by the deadline, you could face interest on the unpaid amount and a failure-to-pay penalty. The failure-to-pay penalty is equal to one half of one percent per month or part of a month, up to a maximum of 25 percent, of the amount still owed.

If you usually get a tax refund, there are several reasons you might find that you owe taxes instead. These include receiving unemployment benefits, changing jobs, sold stock, or made money from a side hustle. Is it better to owe tax or get a refund at the end of the year?

If you claim 0, you should expect a larger refund check. By increasing the amount of money withheld from each paycheck, you'll be paying more than you'll probably owe in taxes and get an excess amount back – almost like saving money with the government every year instead of in a savings account.

What should I put on my W4 to get the most money?

To receive a bigger refund, adjust line 4(c) on Form W-4, called "Extra withholding," to increase the federal tax withholding for each paycheck you receive.

The two groups most likely to get audited are those earning more than $10 million and taxpayers who claim the Earned Income Tax Credit, who tend to be low- or middle-income workers.

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years. The IRS tries to audit tax returns as soon as possible after they are filed.

Yes, after 10 years, the IRS forgives tax debt.

However, it is important to note that there are certain circ*mstances, such as bankruptcy or certain collection activities, which may extend the statute of limitations.

Taking the step of setting up a payment arrangement with the IRS does not trigger any reports to the credit bureaus. As mentioned above, the IRS is restricted from sharing your personally identifiable information. While a Notice of Federal Tax Lien could be discoverable by lenders, the payment plan itself would not.